The capability of this formula to account for fluctuations in prices and inventory quantities efficiently makes it quite practical in real-world scenarios. A more detailed review of the Dollar Value LIFO inventory method provides a broader understanding of its applications in business and accounting. This depth of knowledge is not just beneficial for academic purposes, but also proves advantageous in real-world business scenarios, aiding better decisions regarding inventory control and financial accounting. In 2020, you added inventory worth $20,000, which is a layer on top of the base stock.

- There is software that can automate these calculations and provide real-time inventory updates, making life much easier.

- Dollar-Value LIFO (Last-In, First-Out) is a specialized inventory valuation method that adjusts for inflation and changes in the value of money over time.

- (ii) in the case of a cessation of such an election, the 1st taxable year after such election ceases to apply.

- The Dollar Value LIFO formula helps in deriving an accurate inventory valuation which is crucial for reliable financial statements.

- In an inflationary environment, it can more closely track the dollar value effect of cost of goods sold (COGS) and the resulting effect on net income than counting the inventory items in terms of units.

Dollar-Value LIFO Method Calculation

Previously, companies had considerable flexibility in selecting and applying price indices to adjust their base-year costs. The updated standards now mandate more rigorous documentation and justification for the chosen indices. This change ensures that the indices used are relevant and accurately reflect market conditions, thereby providing a more reliable measure of inventory value. It also reduces the risk of manipulation, ensuring that the financial statements present a true and fair view of the company’s financial position. Understanding Dollar-Value LIFO is crucial because it offers unique advantages, particularly in periods of rising prices.

FAR CPA Practice Questions: Issuing Stock, Stock Dividends, and Stock Splits

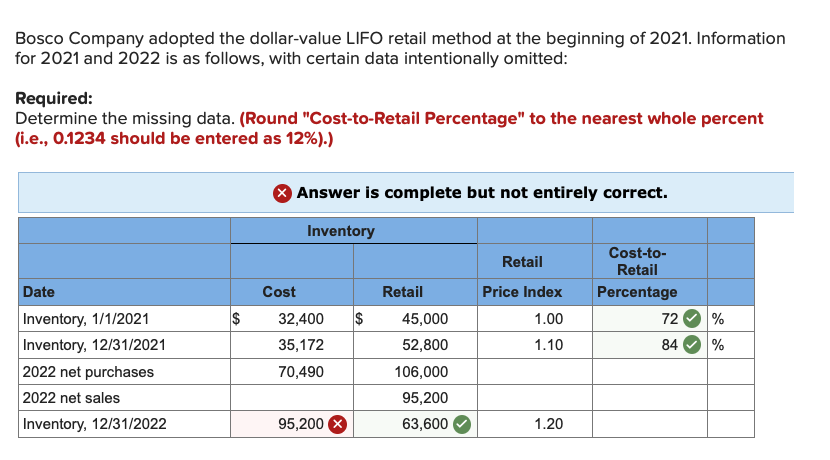

It involves allocating the cost-to-retail ratio to both the beginning inventory and the current period’s layer. In contrast, the dollar-value LIFO retail method considers LIFO principles and adjusts for changes in inventory prices by incorporating fluctuations through the price index. Unlike the prior approach, this process explicitly incorporates variations in inventory prices to determine the estimated cost of ending inventory at annual closing. Dollar-Value LIFO (Last-In, First-Out) is a specialized inventory valuation method that adjusts for inflation and changes in the value of money over time.

Dollar-Value LIFO: Concepts, Calculations, and Financial Impact

While implementing this method, the focus should be on the fluctuations in price levels and their impact on the inventory’s dollar value. A practical example can serve as a highly effective approach to ensure a solid comprehension of the Dollar Value LIFO method. Adopting an example alongside theoretical learning aids in applying the steps involved in this method and visualising the actual working of the Dollar Value LIFO inventory management system. the difference between bookkeeping and accounting Therefore, let’s take a look at a comprehensive example of implementing the Dollar Value LIFO method and learn from it. The price index, which is the ratio of the price level of the current year to the price level of the base year, is utilised to achieve this conversion. The rationale behind Dollar Value LIFO isn’t merely theoretical; it’s an approach you’ll encounter regularly in inventory management within diverse industries and businesses.

This lower valuation can have a cascading effect on various financial metrics. To implement Dollar-Value LIFO, businesses first need to establish a base-year cost, which serves as a benchmark for future comparisons. This base-year cost is then adjusted annually to account for changes in price levels, using a price index. The price index can be derived internally or obtained from external sources like the Consumer Price Index (CPI).

By averaging the cost of all inventory items, this method smooths out price fluctuations, offering a more stable view of inventory costs. While this can be beneficial for companies with volatile prices, it doesn’t provide the same level of tax deferral benefits as Dollar-Value LIFO. Additionally, the weighted average method can sometimes obscure the true cost of inventory, making it harder for management to make informed pricing and purchasing decisions. This method helps in matching current costs with current revenues in the income statement. However, it can be more complex to implement than other inventory valuation methods.

If the converted ending inventory value is less than the previous year’s value, it implies the erosion of a previous layer, following the LIFO principle. Tax benefits are just the tip of the iceberg when it comes to the advantages of LIFO. Suppose ABC Ltd., a manufacturer of fashion apparel, has implemented the Dollar-Value Last In, First Out (LIFO) method for managing its inventory. During the current fiscal year, the company experiences an increase in the costs of raw materials and production due to unforeseen market fluctuations. For purposes of this section, a taxpayer is an eligible small business for any taxable year if the average annual gross receipts of the taxpayer for the 3 preceding taxable years do not exceed $5,000,000. For purposes of the preceding sentence, rules similar to the rules of section 448(c)(3) shall apply.

Instead, the controller assumes that the units sold off are from the most recent inventory layer, which is the Year 2 layer. When combined with the $15,000 cost of the base layer, Entwhistle now has an ending inventory valuation of $34,800. Another notable change is the shift towards more stringent rules on the use of price indices.