By understanding the nuances of traditional income statements, you can gain valuable insights into a company’s profitability, make informed decisions, and assess its financial health. Whether you’re a finance professional, business owner, or simply interested in understanding financial statements, this article will equip you with the knowledge to navigate traditional income statements with confidence. Next, subtract the cost of goods sold, which includes the cost of materials and direct labor. Then, list all your expenses, like rent and utilities, and subtract them from the gross profit. Don’t forget to include both fixed costs, which don’t change much, and variable costs, which can go up or down.

Calculating the Components of Traditional Income Statements

With all of the data you’ve compiled, you’ve now created an accurate statement. Income statements or profit and loss accounts are financial statements used to calculate the financial health of the company. Single-step income statements are the simplest and most commonly used by small businesses.

- Next, we subtract selling and administrative expenses, which are costs not directly tied to making products but necessary for running the business.

- An income statement provides information regarding the “results of operations” of a business, or otherwise known as “financial performance”.

- The income statement enables the calculation of important financial ratios like gross margin, operating margin, and net profit margin, offering valuable insights into the company’s financial health and performance.

- Directors and executives are also provided a clear picture of the performance of the company as a whole during a specific accounting period.

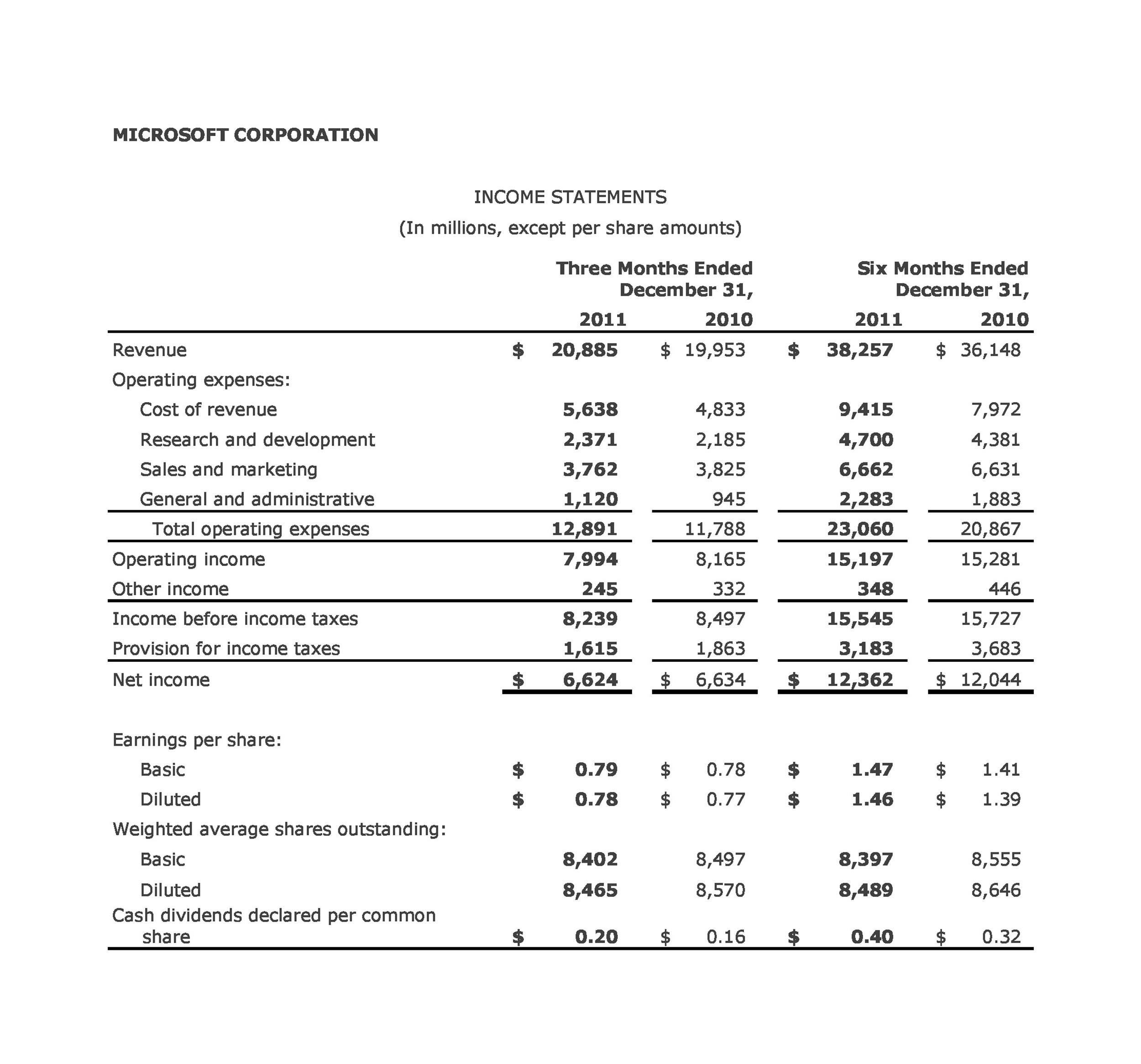

- As you can see at the top, the reporting period is for the year that ended on Sept. 28, 2019.

- GAAP also requires companies to include some portion of their indirect expenses—called selling, general, and administrative costs (SG&A)—in calculating COGS.

Ask a Financial Professional Any Question

The format of a traditional income statement is simpler than the multi-step income statement, which categorizes expenses by function and provides multiple levels of income (e.g., gross profit, operating income). Creditors are often more concerned about a company’s future cash flows than its past profitability. However, their research analysts can use an income statement to compare year-on-year and quarter-on-quarter performance. They can infer, for example, whether a company’s efforts at reducing the cost of sales helped it improve profits over time, or whether management kept tabs on operating expenses without compromising on profitability.

Cash Flow Statement: Cash Inflows and Outflows Concepts

An income statement provides information regarding the “results of operations” of a business, or otherwise known as “financial performance”. If the company has no gains because its costs are greater than its revenue, than it is suffering losses. It is the negative amount after subtracting expenses that are greater than revenue or sales. Whether you’re an individual contributor, a leadership team member, or an entrepreneur wearing many hats, knowing how to write an income statement provides a deeper understanding of the financial state of your business. It can also help improve financial analysis, allowing you to plan for the future and scale your business successfully. Subtract the cost of goods sold total from the revenue total on your income statement.

Cost Accounting Definition

Without this crucial insight, decision-makers may struggle to allocate resources efficiently and accurately assess the overall financial viability of a business. Understanding the income statement is crucial for investors, creditors, and management, as it offers valuable insights into the company’s financial standing and potential growth prospects. Accurate income statements are vital to the success of your small business.

Provides Detailed Information

Learn more about FreshBooks accounting software and give them a try for free. Your cost of goods sold includes the direct labor, materials, and overhead operating expenses you’ve incurred to provide your goods or services. Add up all the cost of goods sold line items on your trial balance report and list the total cost of goods sold on the statement directly below the revenue line item. Next, you’ll need to calculate your business’s total sales revenue for the reporting period.

Therefore, if you are planning to grow, the investors will want to know that your business is stable and making profits. Let us help you get your small business on track with our bookkeeping and accounting services, supported by savvy accounting tech. Gains are the earnings produced outside of the sale of your main goods or services. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

If a company that big can produce a how to use your tax refund to build your emergency funds that simple…so can you. Comparing these numbers, you can see that just over 30% of Microsoft’s total sales went toward costs for revenue generation. These are all expenses that go toward a loss-making sale of long-term assets, one-time or any other unusual costs, or expenses toward lawsuits. Payment is usually accounted for in the period when sales are made or services are delivered. Receipts are the cash received and are accounted for when the money is received. Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice.

For instance, expenses can be delayed or revenue recognised earlier and the appearance of profitability changed. Running a cosy local café or a massive tech company, every business has its own financial needs and goals, and exactly how they execute will differ. To illustrate this, we’ll drill down into two examples and explain how the formats differ between small and large businesses.

The report ends with a total that shows the final result, either a gain or a loss. Revenue is mainly from a company’s core operations—routine sales of products or services. It may also include income from sources that aren’t part of the company’s regular business, called non-core operations. This can include income from discontinued operations, which the company has decided to sell or shut, as well as income from investments, royalties, and fees. Expressed in monetary units, gross margin represents the difference between the selling price and the cost of your products or services. The gross margin shows whether a particular activity is likely to generate income or not.